Tax Outlook for 2022

Posted: January 2, 2022

Written by Attorney Maureen O'Leary, President

The Internal Revenue Service recently announced 2022 annual inflation adjustments for many tax provisions. Following is a brief overview of some key changes for 2022 under current law. However, keep in mind that the following could change at any time if new legislation is enacted.

- The gift tax annual exclusion, which is the amount every US citizen can give tax free during a year, is increased to $16,000 for 2022.

- The lifetime exemption amount, which is the amount above and beyond annual exclusion that every US citizen can give away tax-free during life or at death increases to $12,060,000 per person in 2026 (which amounts to $24,120,000 for a married couple).

Note: The exemption amount is scheduled to drop to approximately $6 million per person in 2026 and it could drop even sooner if legislation was passed before then

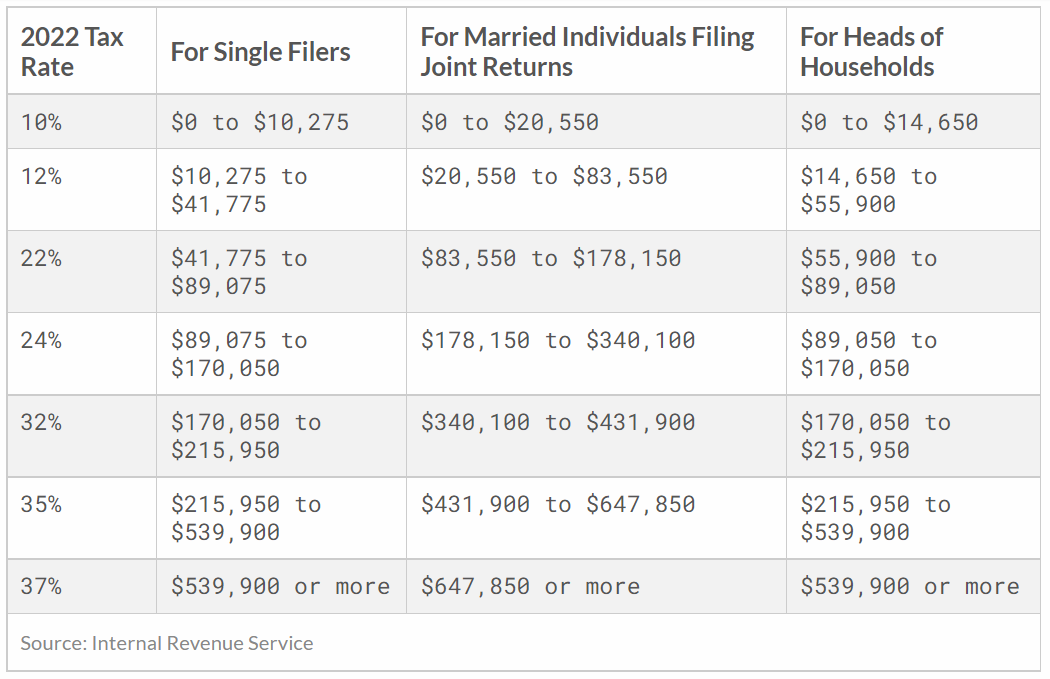

Following are 2022 income tax brackets for ordinary income[1]:

[1] IRS provides tax inflation adjustments for tax year 2022 | Internal Revenue Service

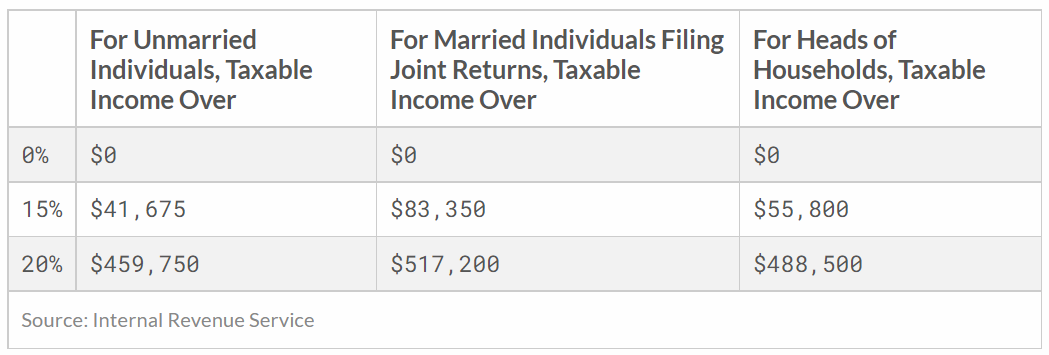

Long term capital gain rates for 2022 are as follows:

Politicians in Washington have been negotiating the Build Back Better Act (“BBBA”) for months. The BBBA as currently drafted includes a revenue generating provision that would impose an extra 5%-8% income tax surcharge on high-income individuals and irrevocable trusts. If enacted, these surcharges are expected to apply to irrevocable non-grantor trusts at much lower income thresholds than the surcharges would apply to individuals and grantor trusts.

More specifically The BBBA proposes high-income surcharges on individuals whose income exceeds $5 million, and on married couples who file jointly with incomes of 10 million 0r more. By comparison, the sure tax would apply to irrevocable trusts with income starting at $200,000, unless the irrevocable trust qualifies as a so-called ”grantor trust” (in which case any taxable activity of the trust is reported on the grantor’s personal income tax return). Because the payment of a grantor trust’s taxes is not a taxable gift, grantor trusts can allow for considerably more wealth to be transferred to the trust beneficiaries.

|

|

Individuals and Grantor Trusts (Married) |

Individuals and Grantor Trusts (Single) |

Non-Grantor |

|

5% Surcharge Begins: |

$10 million |

$5 million |

$200,000 |

|

Additional 3% Surcharge Begins: (3% + 5% = 8% total surcharge) |

$25 million |

$12.5 million |

$500,000 |

Taxing non-grantor trusts more than individuals is not a new concept. Because ordinary income tax brackets for non-grantor trusts accelerate more quickly than the brackets for individual, non-grantor trusts have traditionally been subject to greater income tax than individuals. More specifically, individual taxpayers reach the top tax bracket (currently 37%) at income of $539,900 (single taxpayers) or $647,450 (married taxpayers). However, non-grantor trusts reach the 37% top tax bracket as soon as they have more than a mere $13,050 of undistributed income.

If the rules applicable to grantor trusts were to change, there is a possibility that pre-existing grantor trusts might be grandfathered to some extent. Therefore, if you are interested in establishing a grantor trust, it may be prudent to do so before legislative changes occur.

Please let us know if you have any questions or would like to discuss 2022 exemption levels and tax rates. Further, if you have established an irrevocable trust, are considering doing so, or are a beneficiary of such a trust, and you would like to discuss ways of lessening the tax burdens imposed on trust income, I would be happy to speak with you.

Schedule an appointment with us today.

Meet with a knowledgeable attorney who specializes in your area of law.

1251 W. Glen Oaks Lane, Mequon, WI 53092

F: (262) 238-6999